Aloha, Amazon Seller!

If you’re selling on Amazon, as a rule, you don’t need to register a business or have a business license. But in some cases, you may be required to have one. Proceed reading to find out when.

All sellers on Amazon, as any other U.S. citizen or business, should comply with the law, not least to avoid penalties. If you operate your business without a valid license, at a minimum, there is a risk of a fine or even suspension of operations. However, did you know that 51% or about 3.119 million of 6.09 million Amazon sellers at the end of 2020 were based in North America? And to add note to this, Amazon's earnings are forecast to grow at an exceptional rate of 45.76% per year.

When starting their business on Amazon, a lot of sellers don’t think about obtaining a license. In a general case, they are right, and when you scroll through online recommendations on the point, you’ll find out that a short answer is ‘You don’t need a license to sell online’. In most cases, it is not necessary to have a business license for Amazon since the majority of the products sold on the platform are consumer goods not regulated by the federal government. However, it’s not that simple. Even if you are an SMB located in a particular state, the local government may want you to have a license.

Depending on your home state, you may be required to have general business licenses. For instance, Alaska, Delaware, Nevada, Tennessee, and Washington issue statewide general business licenses. If you’re located in other states, you may need licenses for specific types of businesses, however, e-commerce sales are usually not subject to licensing. Some municipalities may also want you to have a home occupation permit or certificate of occupancy. On top of that, of 45 states with sales tax, each of them but Florida and Missouri require online sellers to get a seller’s permit or sales and use tax permit (in most cases applied to the seller who made at a minimum of $100,000 or 200 transactions within the state).

Said that you now understand, that it’s a good idea to check with local, county, and state officials whether you’ll need a license for your business or not.

In this blog we will look into legal requirements to sell on Amazon, will answer the question ‘Do you need a business license to sell on Amazon‘, and will discuss when you’ll need to get a license for Amazon sales.

What is a Business License?

A business license is a legal document issued by a state or other government entity confirming that a business is entitled to be engaged in a particular type of business activity in the city, state, or country that issues it. A license indicates that the company has the government’s approval to operate.

Government agencies can charge penalties or even completely close a business that operates without a license, therefore it’s essential to comply with license regulations.

Not all businesses have to obtain licenses. This depends on the type and scope of business you run, the category of goods you sell or produce, the location of your business, and operations. Depending on the type of your business, the government may want you to have a local, county, state, or federal license – or none of it.

From the government’s perspective, the reason to have a license is to protect the customers from cheaters when it comes to their health and safety. Being licensed by the agency shows your shoppers that you comply with the federal and state regulations for safety, cleanliness, and honesty.

Do You Need a Business License to Sell on Amazon?

Generally, if you’re selling your inventory online, you don’t need to obtain a business license. Consumer products commonly sold on e-commerce platforms like Amazon, typically do not require any federal approvals.

However, despite that your retail sales on Amazon happen online, your business is regulated by the laws of the state where it’s registered and the county or municipality where it’s physically located. Therefore, it depends on the state and locality whether you need a license to sell online or not. From Amazon sellers, the majority of the states require to have a seller’s permit or sales tax license.

IRS clarifies, that depending on the state where you reside you may be subject to state and local taxes, as well as other regulations, such as the necessity to get a business license. E-commerce businesses follow the same licensing requirements as brick-and-mortar retailers, which differ by state, county, and municipality. Therefore, to be on the safe side, it’s a good idea to verify the regulations for the particular states you operate in.

If you’re an SMB, a private label, or a retail arbitrage seller, the license is most likely not required. However, if you’re going to sell wholesale products, chances are that you’ll need an Amazon seller business license and sales tax permit.

What are the Kinds of Business Licenses?

To sell goods or services, it may be required to obtain one or more types of business licenses, like business operating licenses, seller’s permits, DBA, and more. Some licenses and permits expire after a set period of time, therefore you’ll need to keep that in mind since it’s easier to renew them than to apply for a new one.

Types of Business Licenses

A business operating license is a permit that lets you do business in your state or locality. You may need to get it from either a state, city, or county. You can find a list of requirements by the U.S. state here.

Seller’s permit - if you sell inventory online, the majority of states will want you to have it since it allows you to collect sales tax from customers. You can also read in detail about Amazon seller taxes in our blog.

DBA (fictitious name statement) is a “doing business as” statement giving you the possibility to run a business under a name different from your legally registered business name. In different states, DBA is registered at a state or local level.

Special permits – may be needed, for instance, for brick-and-mortar store owners for planning, building, signs, etc.

Industry licenses may be necessary for businesses related to human health and safety, like electrical, childcare, medicine, and law. These licenses are issued by the state licensing boards.

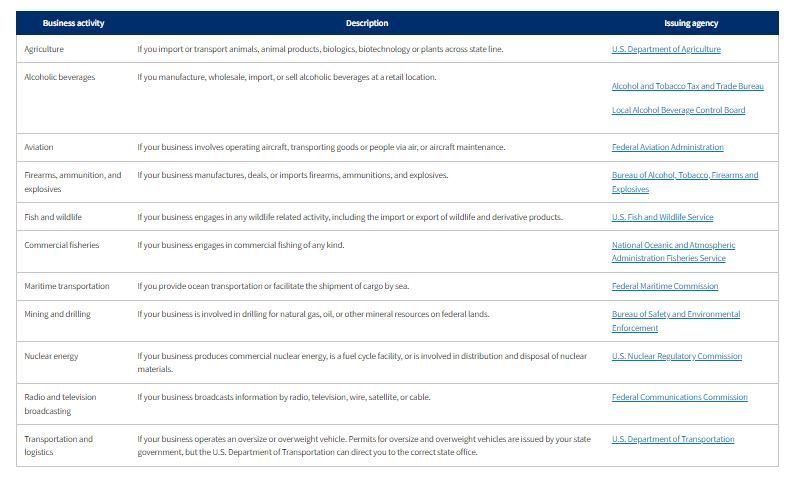

Federal licenses are issued for certain types of goods in 11 different industries, like agriculture, alcoholic beverages, firearms, ammunition, explosives, mining and drilling, and more.

Is LLC and Business License the Same?

A business license is a government-issued document certifying that your business is safe for the public.

A business license for Amazon is not the same as forming an LLC. An LLC is a legally recognized business entity while an Amazon FBA business license gives you permission to engage in a specific type of business in a certain jurisdiction.

It is not necessary to have a business license for Amazon FBA to sell the majority of the products on Amazon since they are not regulated by the federal government. Most online sales are consumer products that do not require government approval.

How to Obtain a Business License?

The process to obtain a business license varies state by state. Typically, you’ll need to form a business entity, apply for EIN, and after that apply for a business license on an SBA or other relevant website.

Getting a Business License Step-by-Step

Step 1. Create a Business Entity

Since a business license is issued in the name of your business, it’s best to select a business structure and business name so that you don’t need to change it afterward.

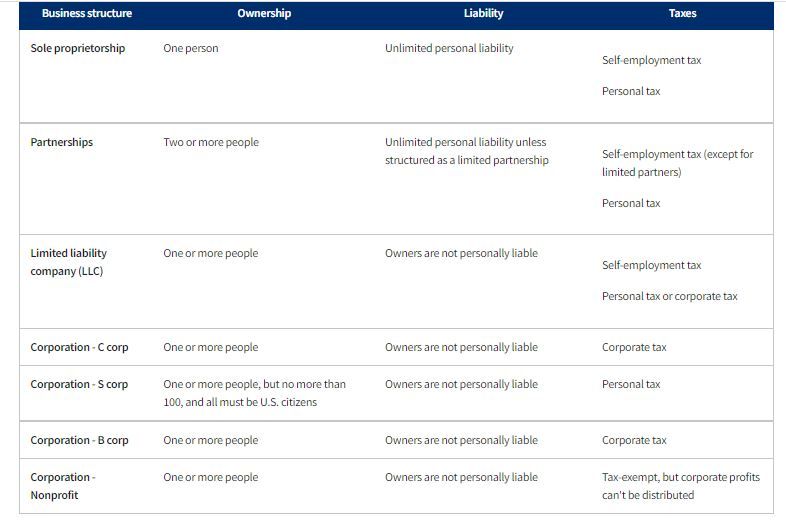

Legal structures for SMBs are sole proprietorship (a one-owner business); general partnership (partners share tax and other liabilities); Limited liability company (LLC- personal assets are separated from business liabilities); corporation (a bigger entity with a fixed operating structure); nonprofit corporation (profits can’t be used by corp’s owners).

Step 2. Apply for an Employer Tax Identification Number (EIN)

You can apply for EIN on the IRS website. In your state, you may be required to include your federal tax ID number on your business license form. Sole proprietors can use their Social Security Numbers instead.

Step 3. Find out which license you require

There are several ways you can research which licenses you do or don’t need.

Visit your local Small Business Administration office or check the SBA website;

Ask your state’s Secretary of State office, Department of Revenue, or other agency responsible for issuing business licenses in your locality;

Consult your lawyer or accountant.

Step 4. Apply for a business license

You can file an application on the SBA’s website or in your state or your local SBA office.

Step 5. Renew Your Business License

You may need to renew a license annually or every five years.