Aloha, Amazon Seller!

A basic concept like Amazon's Сost of Goods Sold (COGS for short) is easy to understand. Read the article and learn how to calculate the cost of sales.

When you sell on Amazon.com, as everywhere, it is very important to monitor your product's profitability, margins, and expenses to successfully run your business. Doing sales on the platform means that you are proactively developing your business, monitor your inventory KPIs and figure out rising or falling trends in order to timely eliminate the problems and change the strategy you apply. Also, on Amazon, your performance influences your Account Health Rating.

Doing your finance, you need to each month account for the inventory value and expense to maintain turnover rates and plan for growth. When you know the profit margin you earn, you can see how much you can invest in your business expansion.

To calculate your monthly gross profit, you need to account for the expenses related to the cost of goods sold, since the profit margin is the difference between the sale price and the cost of goods.

In this post, we will tell you what is Amazon cost of goods sold and how to calculate it.

What Is the Cost of Goods Sold?

Cost of goods sold (COGS) refers to the costs of producing (or acquiring) the goods sold by a seller. This amount includes the cost of the materials and labor needed to produce the item (or its cost when you buy and resell it).

Sales COGS includes the costs and expenses associated with the production of goods, however COGS expense excludes overhead costs such as marketing, distribution, etc.

Since COGS is deducted from the sale price, the higher is the COGS, the lower is the profit margin.

Cost of goods sold is also referred to as "cost of sales", therefore when you wonder how to calculate cost of sales, you need to compute the COGS.

The value of COGS will vary depending on the accounting standards applied in the calculation.

On Amazon, the cost of goods sold (COGS) is an expense. It is an accounting principle matching the cost of an item and its sale. With the help of this metric, you can track your revenue and profitability in a specific month. It helps you better manage your inventory.

Why Is It Important to Know Your Sales COGS?

With regard to your sales, COGS are expenses, alongside Amazon Fees, Order Fees, FBA Fees, etc.

Since COGS is a cost of doing business, a statement of cost of goods sold is recorded as a business expense on the income statements. Generally, the cost of goods sold data helps business owners or investors estimate the bottom line of the business. If COGS is high, net income is low, and the business will generate less profit.

Knowing your COGS, therefore, is important to estimate your revenues, gross margins, and profitability in a given month. Accounting for COGS gives you more accurate control over your inventory.

What Does Cost of Goods Sold Include?

As said, the cost of goods sold explained simply includes the costs related to the item’s production, and does not include overhead costs.

COGS include:

- Procurement costs;

- Production costs / acquiring costs;

- Packaging costs;

- Taxes and duties;

- Listing fees;

- Inventory storage fees and costs.

For an Amazon seller, it is important to keep the COGS low. You will prefer to either look for the manufacturers offering moderate prices if you resell the products or review the production cycle if you are the manufacturer yourself.

What Is Cost of Goods Sold In Accounting?

In order to calculate the COGS expense, a formula for the cost of goods sold is used.

COGS formula accounting is:

Let’s take an example with figures.

You bought inventory for $10,000 at the beginning of the year and an additional inventory of $10,000 a couple of months later. At the end of the year, the inventory for $2,000 was left. Your COGS will be calculated as follows:

COGS = $10,000 + $10,000 - $2,000 = $18,000

If you are a manufacturer of your inventory, The U.S. Internal Revenue Service (IRS) gives the following formula:

(Inventory at the beginning of the year + net purchases + cost of labor + materials and supplies + other costs) - inventory at the end of the year = Cost of Goods Sold (COGS)

Calculating COGS and Accounting Methods

The value of the cost of goods sold depends on the inventory costing method you apply. There are three methods to recording the level of inventory sold during a period: First In, First Out (FIFO), Last In, First Out (LIFO), and the Average Cost Method.

First-In, First-Out, or FIFO

Under this method, you assume the oldest units of inventory are always sold first.

Example. You bought 200 branded t-shirts on Monday at a cost of $10 each, and 200 more on Tuesday at $10.25 each. FIFO states that if you sold 200 t-shirts on Wednesday, the COGS (on the income statement) is $10 per t-shirt because that was the cost of each of the t-shirts you bought first in your inventory. The $10.25 t-shirts would be allocated to ending inventory (on the balance sheet).

Last-In, First-Out, or LIFO

This is the opposite approach, in which the newest inventory is sold before the oldest.

Example. For the 200 t-shirts sold on Wednesday, you would assign $10.25 per t-shirt to COGS, while the remaining $10 t-shirts would be used to calculate the value of inventory at the end of the period.

Average Cost Method

The average price of all the goods in stock, regardless of purchase date, is used to value the goods sold.

Example. In our example with t-shirts, the average cost for inventory would be $10.125 per unit, calculated as [(200 x $10) + (200 x $10.25)]/400.

Note. Companies in the US operate under the generally accepted accounting principles (GAAP), while most other countries adhere to the International Financial Reporting Standards (IFRS). The GAAP accepts the three most common inventory valuation methods, while the IFRS doesn’t accept the LIFO method. This means if your business is based outside the US, it’s likely you won’t be using the LIFO.

How to Easily Upload COGS in Bulk?

For the sellers, who deal in a large number of various items, each having its individual acquisition cost, it is very time-consuming and irritating to manually input the cost of goods sold for each product. A lot of them- are complaining, that keeping records of the cost of goods sold is time-consuming and very cumbersome. However, for Amazon sellers, it is very important to monitor the COGS as it relates to the revenue and true profitability of a particular product.

With the functionality from SelleRise, there is no need to manually enter the cost of goods for each product. You can simply fill in the table and upload your data.

Why Should You Upload Cost of Goods in the SageSeller’s Inventory Manager Dashboard?

The new functionality developed by SageSeller for your convenience, allows you to fill in the table and just upload the file.

If you normally store the cost of goods data in the Excel file, or any type of accounting software, from which you can export your data, you would only need to format it according to the SageSeller’s template.

The cost of goods data uploaded in the SageSeller’s Inventory Manager is further applied to help the seller with the inventory management and product metrics efficiency monitoring. With the SageSeller’s Inventory Manager, the seller receives operational information about the number of goods in the warehouse and their condition. You can quickly make decisions on how much inventory you will need, and filter products by account. The cost of goods is accounted for to calculate the product profitability and to take into account the cost price of FBM items.

How to Upload the Cost of Goods to SelleRise?

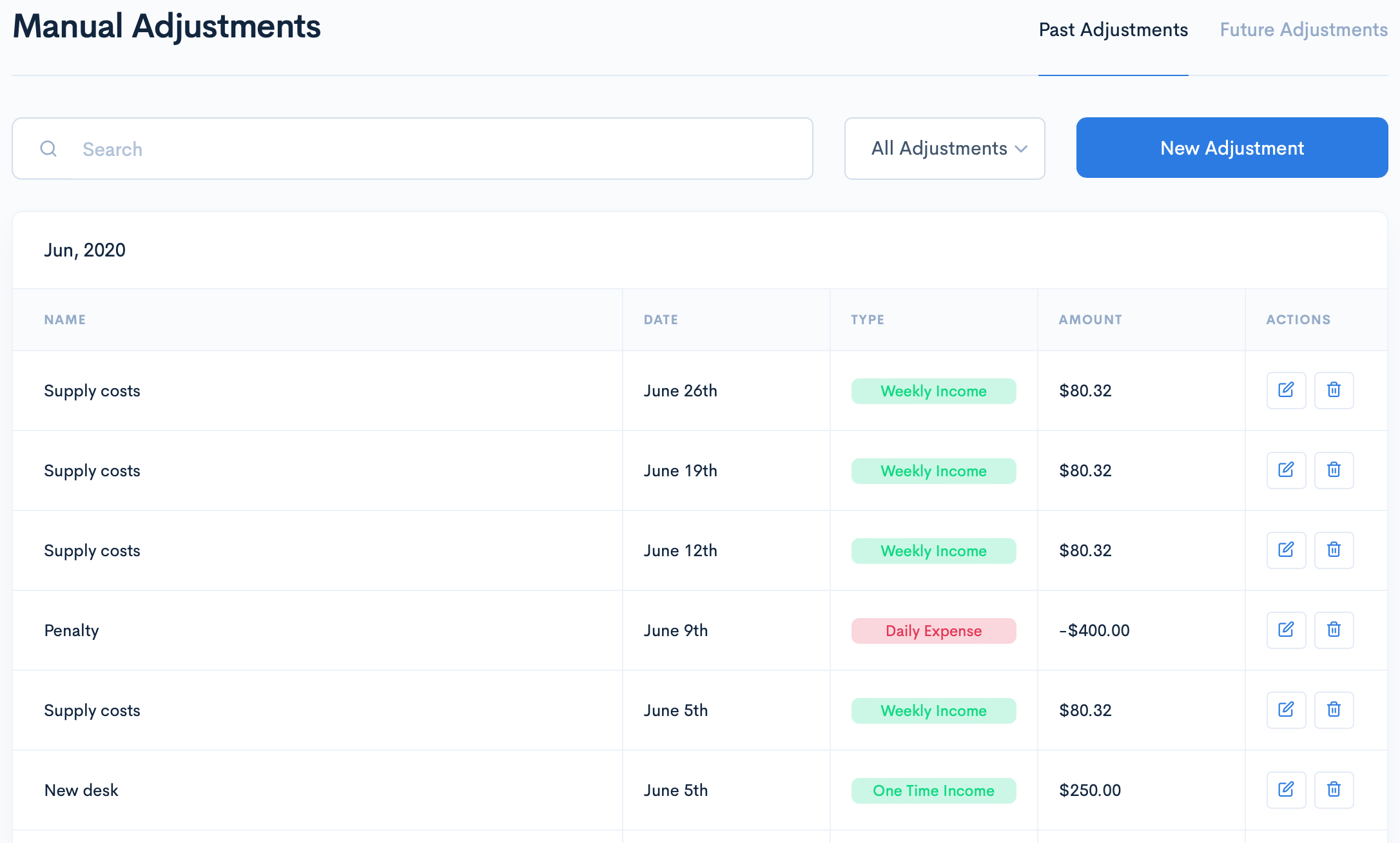

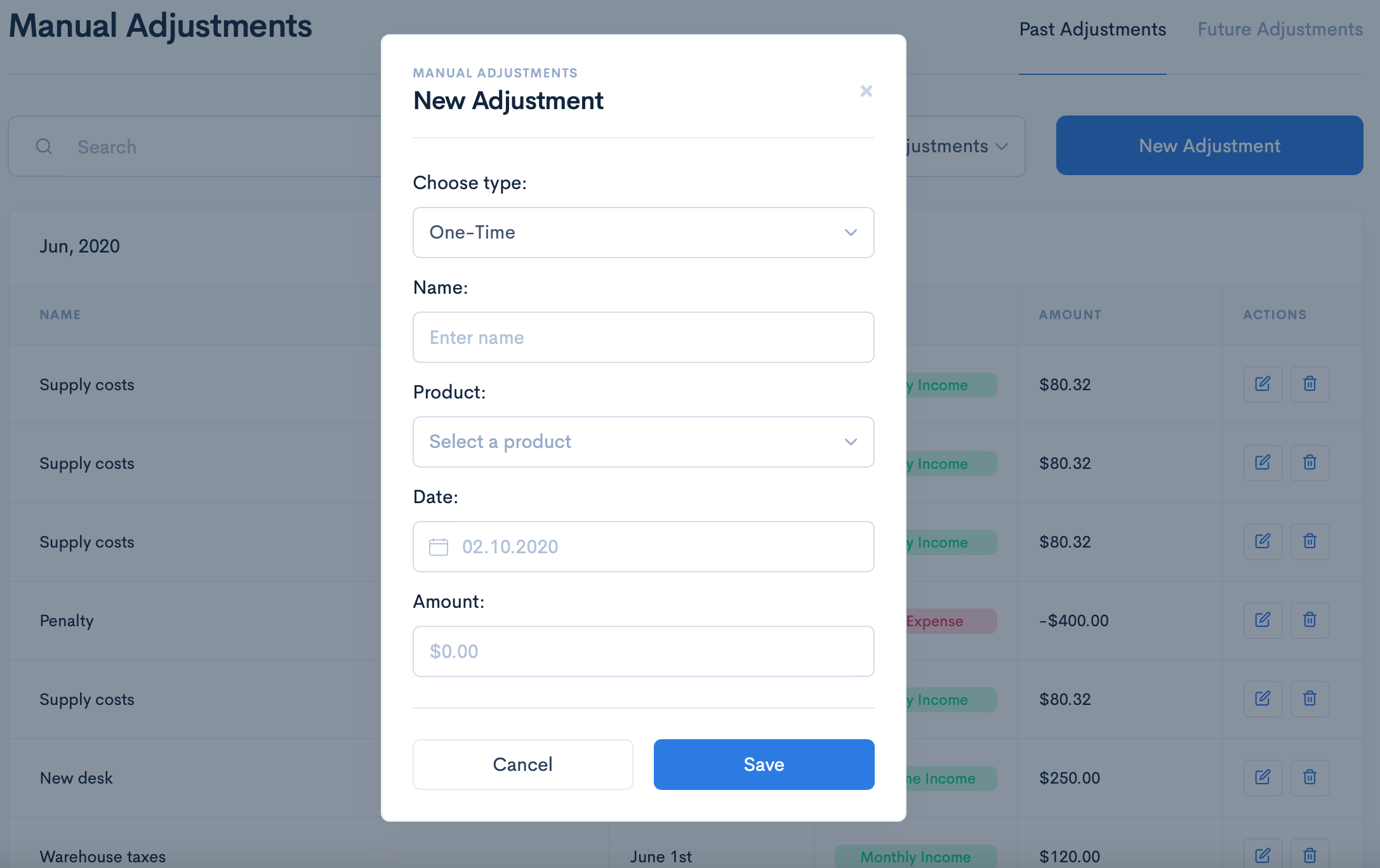

In order to import the cost of goods data, the seller should log in to their SelleRise account and navigate to SelleRise’s Manual Adjustments.

In the upper right-hand corner of the page press the “New Adjustment” button.

SageSeller wishes you perfect sales and reminds you about the importance of monitoring your FBA and FBM sales analytics separately. You can do it easily and conveniently with SelleRise's dashboards.

Try SelleRise's now and get 7-days free trial benefits.