Aloha, Amazon Seller!

What is a business audit? How to audit a business on Amazon? Learn a complete guide about an audit for online businesses and who can help you to do it.

In today’s e-commerce world, things are changing very fast. Competitors are introducing new strategies, new keywords are popping up, new technologies are emerging, and Amazon always changes something. You have to keep up with the times very quickly, to retain the existing customers and attract new ones.

In this regard, there’s no such thing as a finalized brand or Amazon store. It evolves all the time, which means that you need to from time to time review your storefront’s performance, as well as the sales and marketing strategies behind it, to set new goals and achieve them.

A comprehensive analysis of a business you’ve created so far and of the metrics you can improve to grow web traffic and conversions is usually performed through an audit. Depending on the purpose, you may apply different types of audits to your business, like internal or operations audits. The financial audit will be more common in the case when you’ve decided to sell your Amazon business.

What Is Online Business Audit?

Commonly, a business audit evaluates a company’s financial statements and reveals if there are any errors or missing information with regard to standards, evidence, and assumptions used to conduct it. It covers financial statements, regulatory requirements, and internal controls.

Unlike a regular small business audit, which concentrates on the accuracy of records and financial statements, an e-commerce audit prioritizes analyzing your content efficiency, customer journey optimization, and business metrics performance.

What Is Business Amazon Audit and How It Differs?

On Amazon, an audit is a bit different compared to a website audit. Given that Amazon has certain specific metrics applied to estimate business efficiency, which is rarely used anywhere outside the platform, like ACoS, they should be taken into account in the Amazon audit report.

Amazon business audit typically evaluates Amazon seller account health, profitability, ranking, the performance of the ASINs, net profit, inventory turnover levels, PPC spends (ACOS / TACOS), and COGS margins.

The reasons to perform Amazon business audit include:

- Analysis of business’s health and economy;

- Monitoring of business metrics effectiveness;

- Verification of business and marketing strategies;

- Checkup of customer experience interactions;

- Examination of operations processes quality;

- Review of financial information;

- Review of business compliance;

- Identification of business opportunities;

- Risk evaluation;

- The proposition of improvements;

- Estimating business value.

How to Audit a Business?

According to audit standards, it should be performed by an authorized person or a company, having professional knowledge and qualifications in financials and law, and expertise in the e-commerce industry. As said, Amazon businesses have valuation criteria that differ from other industries, therefore an auditor should have expert knowledge in Amazon.

3 Steps of Amazon Audit

Audit’s function is to define where the Amazon business stands, analyze its parameters and their performance, and propose ways to further grow and improve it.

# 1. Monitoring

The audit starts with getting a full picture of Amazon account product metrics, reviews high & low-performing ASINs, key listing and account metrics, sales conversions ratio, best seller rank (BSR) rates, advertising campaign performance, inventory management parameters, etc.

With Sage Audit, there’s no need for Amazon seller account integration, it’s enough with an Amazon store link to monitor the account.

# 2. Analysis

The second step of the audit includes an in-depth analysis of key business indicators, reviews BSR history, profit analytics, inventory rate, perform review cheating checkup, refund rate, keyword ranking, and other metrics of Amazon store.

# 3. Audit Report

After Amazon business’ monitoring and analysis are completed generates an audit report. The report visualizes business analytics is shown in the charts and dashboards. They are easy to read and understand, and sellers can immediately see the overall trends of their store and statistics down to each ASIN.

What are the Advantages of performing audits?

Advantage 1. It’s Simple

When you perform an audit of the Amazon seller account, often you need to do a complicated and durable integration.

After that, you follow 3 simple steps: conclude the Service agreement, receive an audit report, and pay for the report upon reception.

Advantage 2. It’s Prompt

Find out a sophisticated software allows for the overall audit within 24 to 72 hours, depending on the complexity of Amazon business audited and the number of stores.

The Metrics Analyzed:

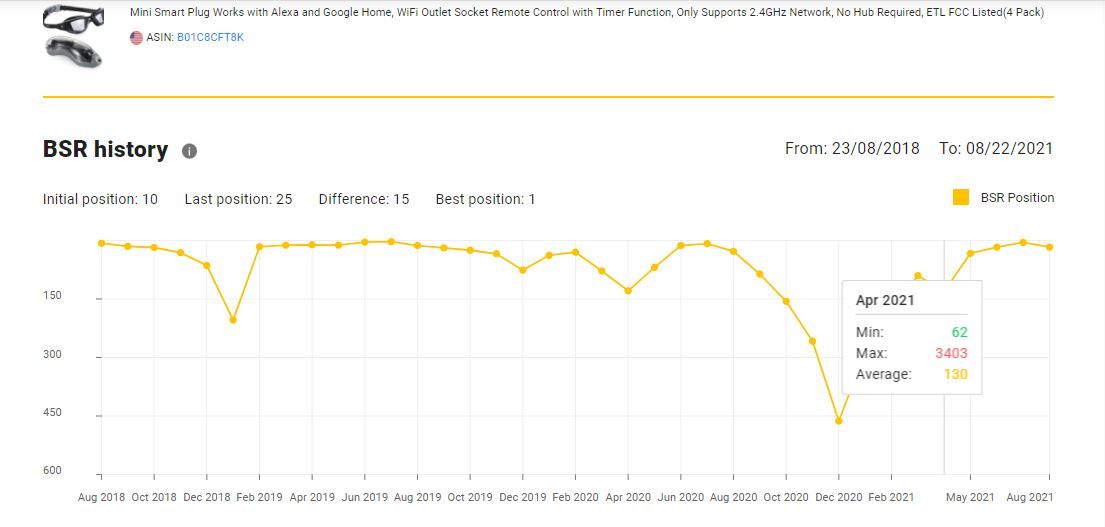

BSR History

Best Seller Rank history and dynamics are shown in the chart for each ASIN by date, including timing and fluctuations.

Profit Analytics

Most important Amazon business’s sales metrics are analyzed, displaying aggregate store’s data and figures for each SKU. Net Profit, Margin, ROI, Sales Revenue, etc. are visualized in the Profit Dashboard.

Inventory Rate

Inventory status is reviewed over the year, stock age and quantities are displayed in the chart displaying aggregate store’s data and figures for each SKU by date.

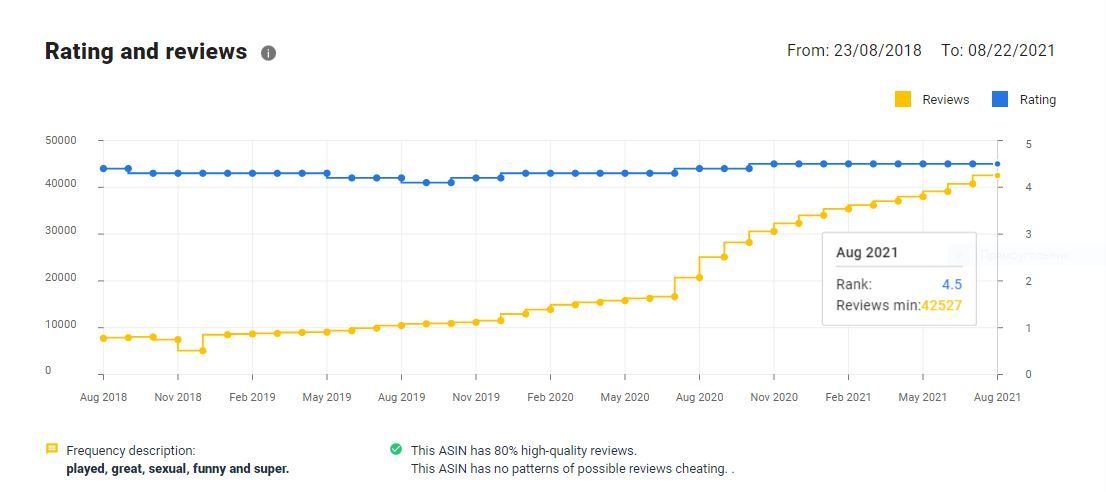

Review Cheating

Review history and authenticity are anatomized. The chart shows reviews origin, quality, and quantity for each ASIN by date.

Refund Rate

Refund quantity and reason are visualized in the pie or bar chart displaying aggregate store’s data and figures for each ASIN, with a refund rate percentage.

Keyword Ranking

Product keyword ranks are displayed in the table for each ASIN and key.