Aloha, Amazon Seller!

If you are selling a lot of products on Amazon, tracking the cost of goods sold is a real headache. However, you need to know the difference between the sale price and the cost of goods to understand the profit margin you earn. With the new SelleRise's functionality, you can easily upload your cost of goods (COGS) to SelleRise and monitor all your inventory metrics using SelleRise's Inventory Manager Dashboard.

The new functionality from SelleRise allows you to just fill in the table and import your data, you don’t need to manually enter the cost of goods for each SKU.

SelleRise's Inventory Manager Dashboard helps the seller track and control the stocks of goods in Amazon fulfillment centers. You can monitor the number of units of goods that are located in the Amazon fulfillment centers, the cost price of goods per marketplace and item, your profit, and a lot of other metrics.

What is the Cost of Goods on Amazon?

The cost of goods sold (COGS) is an expense. On Amazon, it is an accounting principle matching the cost of an item and its sale. With the help of this metric, you can track your revenue and profitability in a specific month. It helps you better manage your inventory.

The cost of goods includes Cost of Goods per Unit, Supplier Shipping Cost Per Unit, and Miscellaneous Cost. The cost of the product is deducted from the value of your inventory and applied against the revenue from the sale, for the calculation of the gross profit. This happens only in the case when you sell that product.

Why Is It Important to Track Your Cost of Goods?

With regard to your sales, COGS are expenses, alongside Amazon Fees, Order Fees, FBA Fees, etc.

Amazon Cost of Goods Sold indicates how much is the cost part in the product price’s structure, and if it’s too high, you can try and lower the costs incurred or stop selling the product. COGS can also be applied to compare the costs of various products. GOGS can be very useful to determine the right pricing strategy for Amazon products you sell. This value is one of the indicators of your Amazon account health. Being an expense, proper accounting of COGS helps efficiently manage taxes.

On top of that, COGS Amazon is used in various formulas and calculations, showing the efficiency of your business metrics. For instance, COGS is applied to calculate gross margin, COGS ratio, and inventory turnover.

A lot of Amazon sellers are complaining, that keeping records of the cost of goods sold is time-consuming and very cumbersome. However, for Amazon sellers, it is very important to monitor the COGS as it relates to the revenue and true profitability of a particular product.

With the new functionality from SelleRise, there is no need to manually enter the cost of goods for each product. You can simply fill in the table and upload your data.

Why Should You Upload Cost of Goods in the SelleRise's Inventory Manager Dashboard?

For the sellers, who deal in a large number of various items, each having its individual acquisition cost, it is very time-consuming and irritating to manually input the cost of goods sold for each product. With the new functionality developed by SelleRise for your convenience, you can fill in the table and just upload the file.

If you normally store the cost of goods data in the Excel file, or any type of accounting software, from which you can export your data, you would only need to format it according to the SelleRise's template.

The cost of goods data uploaded in the SelleRise's Inventory Manager is further applied to help the seller with the inventory management and product metrics efficiency monitoring. With the SelleRise's Inventory Manager, the seller receives operational information about the number of goods in the warehouse, and their condition. You can quickly make decisions on how much inventory you will need, and filter products by account. The cost of goods is accounted for to calculate the product profitability and to take into account the cost price of FBM items.

How To Upload the Cost of Goods to SelleRise?

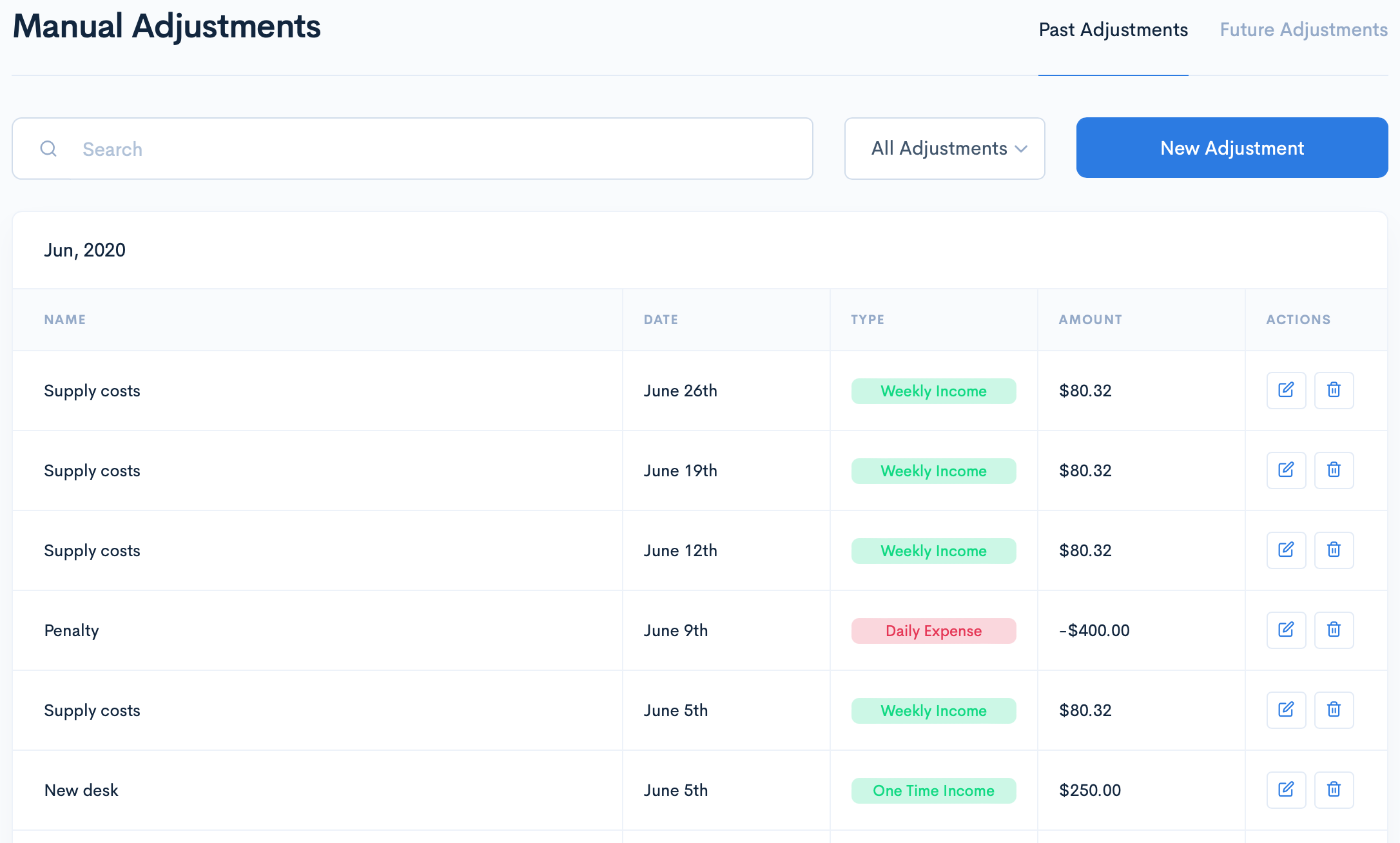

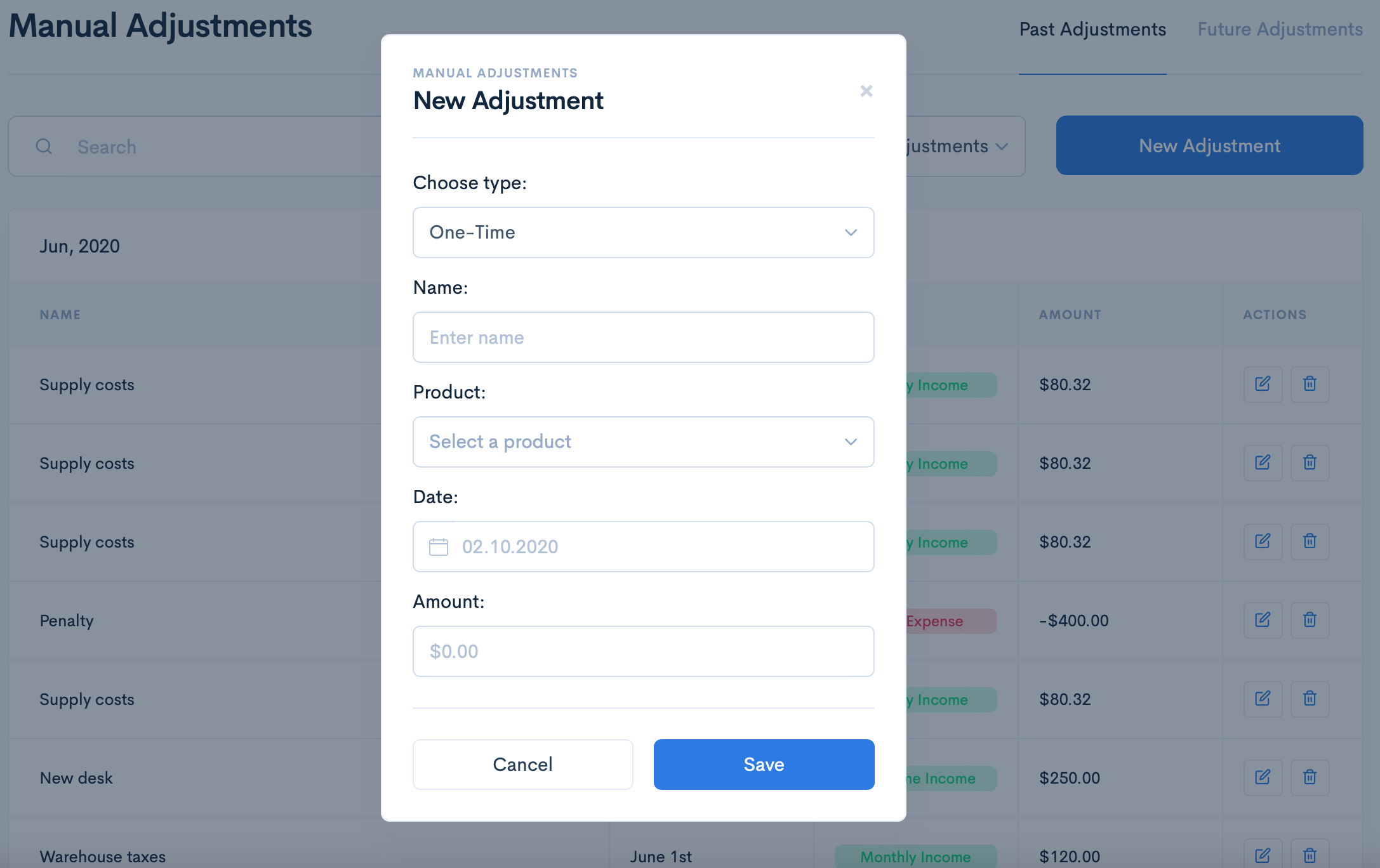

In order to import the cost of goods data, the seller should log in to their SelleRise account and navigate to Manual Adjustments .

SelleRise wishes you perfect sales and reminds you about your FBA and FBM sales analytics.

Try SelleRise now and get 7-days free trial benefits!

It's a pretty good time to make sure it's the simplest service.